CHECK ACCEPTANCE PROCEDURES AND SAMPLE CHECK

The check acceptance procedure described below, when practiced routinely, can greatly increase the effectiveness of the District Attorney's Bad Check Program. The identification of the check writer is the key to successful prosecution and collection of restitution for victims.

A) Ask to see a current driver's license.

- Look at the check writer’s driver's license. Look at the check writer. Is it the same person?

- Write the check writer’s driver's license number and expiration date on the check.

- The person accepting the check should put their initials next to the driver's license number to identify the check acceptor.

- If the driver's license number is imprinted on the check, the acceptor should look at the check writer's driver's license to verify that the imprinted information on the check matches. Circle the driver's license number, write the expiration date on the check and initial next to it.

- If the check writer writes their driver's license number on their check, make sure it matches the driver's license they are presenting. Circle the license number, write the expiration date on the check and initial next to it.

- If the driver's license presented does not match the name imprinted on the check, don't accept the check.

- If the person passing the check is not the owner, signer or imprinted name on the check, don't accept the check.

B) Ask for a work phone number.

C) Avoid taking:

- Two-party checks

- Out-of-state checks

- Altered checks

- Income tax checks

- Insurance claim checks

- Counter or temporary checks

- Post-dated or stale-dated checks

- Non-personalized checks

REMEMBER:

Use common sense: if in doubt, call the bank and verify that the check is good.

Weigh the possible loss you may take against the possible gain.

Be particularly cautious on weekends and holidays.

Do not permit yourself to become flustered by the shopper who is in a rush; be courteous, but careful.

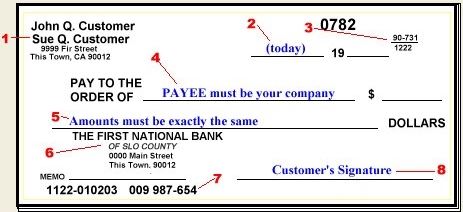

SAMPLE CHECK:

Read every check carefully for the following eight points:

- Must be Personalized - Complete name and address pre-printed by the bank (no P.O. Boxes).

- Date must be current - Never post-dated.

- Bank I.D. #

- Payee must be your company.

- Amounts written and numerical must be the same.

- Bank name and address must be printed on check.

- Bank and customer computer numbers must be printed on check.

- Customer signature - Must be signed in your presence.