Budget Development and Management

The Executive Office develops and publishes the County's budget document every year. This document serves as a spending plan that demonstrates, in measurable terms, how County government runs efficiently, provides high-quality services, complies with all legal requirements, and produces results that are responsive to community priorities and desires. The budget reflects the County’s disciplined approach to fiscal management and is consistent with our goal to provide a safe, healthy, livable, prosperous and well-governed community.

What is the process?

Financial Forecast

The Executive Office presents a financial forecast to the public at a Board of Supervisors meeting in October.

Set Priorities, Strategic Plan

The Board of Supervisors meets in November to adopt the next fiscal year budget goals and policies, establish budget priorities, and adopt the County's fee schedule for the coming calendar year. The Executive Office also provides the current fiscal year's first quarter financial report to the public and the Board.

Set Goals, Performance Measures

In December, departments develop goals and identify metrics to measure performance for the next fiscal year.

Department Budgets Submitted to Executive Office

In January, departments submit next fiscal year's budget requests to the Executive Office.

Budget Update to Board and Public

The Executive Office presents a budget update to the Board based on requests submitted by departments. The Executive Office also provides the current fiscal year's second quarter financial report to the public and the Board.

Review, Analyze Budget Requests

In February and March, the Executive Office reviews and analyzes budgets submitted by departments for the next fiscal year and begins developing recommendations for the Board.

Finalize Recommendations

In April, the Executive Office finalizes budget recommendations for the next fiscal year and prepares the recommended budget for the public and the Board of Supervisors to review.

Publish Recommended Budget

In May, theExecutive Office publishes the recommended budget for the next fiscal year and introduces it to the public and the Board of Supervisors. Any changes are then noted and prepared in a supplemental document to the budget. The Executive Office also provides the current fiscal year's third quarter financial report to the public and the Board.

Budget Hearing

Every June, the Board of Supervisors hold public budget hearings to review, revise and/or adopt the recommended budget for the next fiscal year. The current fiscal year ends on June 30.

New Fiscal Year Begins

The new fiscal year begins on July 1.

Capital Improvement Projects, Fund Balance Available

In August, departments submit Capital Improvement Project requests to the Executive Office. The County also identifies the fund balance available from the previous fiscal year.

Budget Finalized

In September, the final budget for the current fiscal year is adopted to include the fund balance available identified in August. The Executive Office also provides the previous fiscal year's fourth quarter financial report to the public and the Board.

Who is eligible?

Anyone can participate, and is encouraged to participate, in the budget process. Public participation is available through the many public budget-related meetings that are held by the Board of Supervisors throughout the year. All Board meetings are recorded and broadcast via cable television and the County’s website.

We measure community needs through community input provided through participation in open meetings, public involvement on the County’s many advisory boards and commissions, and through studies and community-wide reports.

Is there a charge for this service?

Printed copies of the budget book can be purchased for $43, but anyone can access the County budget document for free online or at all branches of the County Library.

Visit the Executive Office in the County Government Center in downtown San Luis Obispo to purchase a printed copy of the budget book.

When and where is this service offered?

Throughout the year, the budget is developed and reviewed starting with a financial forecast in October and ending with the final budget adoption in September of the following year. The Board of Supervisors also holds a strategic planning meetings in the Board Chambers at the County Government Center in downtown San Luis Obispo to discuss and adopt goals and policies, establish priorities, and adopt the County's fee schedule. This is an opportunity for members of the public to weigh in on the Board's priorities and have a say in the process.

Then, in June, the Board holds public budget hearings in the Board Chambers at the County Government Center in downtown San Luis Obispo to review, revise and/or adopt the proposed budget for the next fiscal year. This again is an opportunity for members of the public to weigh in on the County's budget.

Location, directions and hours of operation

Click on location name to show hours of operation, directions and phone information

Monday - Friday 8-5

1055 Monterey Street D430

San Luis Obispo, CA 93408

Fax: (805) 781-5023

Tel: (805) 781-5011

FAQS

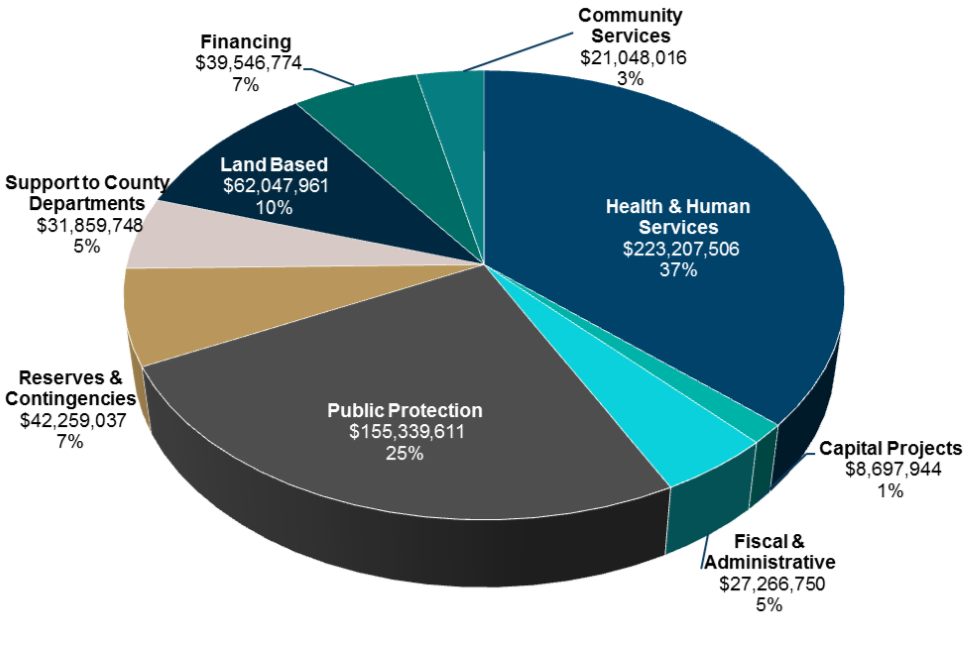

The majority of government funds are spent on health and human services (such as Public Health, Social Services, etc.) and public protection services (such as the Sheriff's Office, Probation Department, County Fire Department, and the District Attorney's Office). To give you an idea of what that looks like, the pie chart below shows how much of the County's $611.3 million were divided up among various public service group in FY 2017-18.

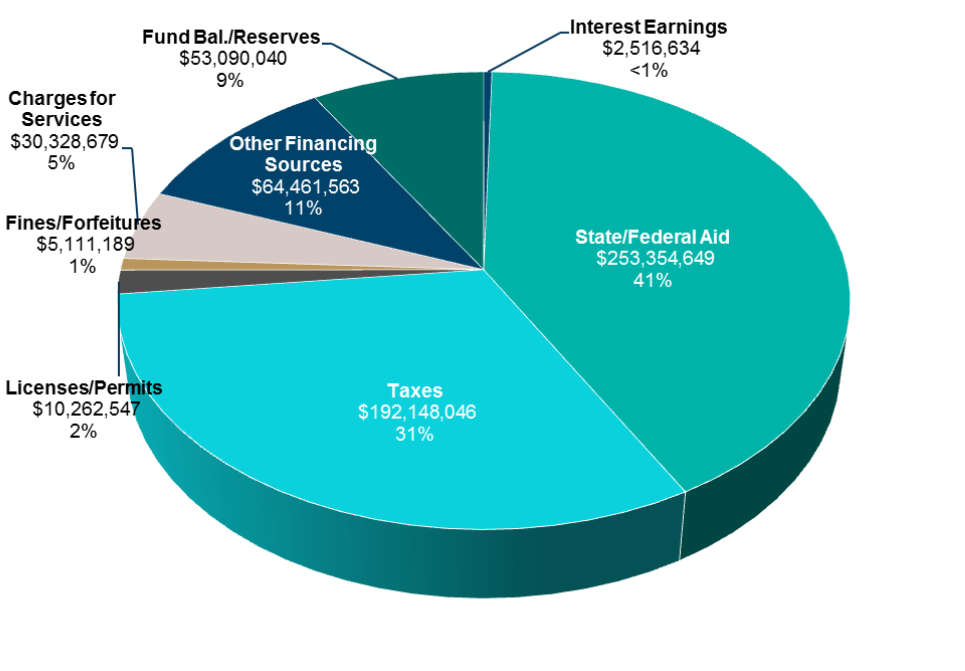

Contrary to popular belief, the County's revenue does not come solely from property taxes. In fact, only about 31% of the County's revenue in FY 2017-18 came from taxes, while 41% came from State and Federal Aid, 11% came from other financing sources, 9% from balance leftover from the previous fiscal year and/or reserves (savings), 5% from charges for services, 2% from license and permit fees, 1% from fines and forfeitures, and less than 1% from interest earned on various accounts. Here's a breakdown of what that looks like:

The County's budget is perhaps the most important document published by the County of San Luis Obispo. It serves as the most concrete expression of public policy. Think about your personal finances. How you spend your money reflects your goals. Similarly, how the County spends public funds reflects what the County hopes to accomplish in a given fiscal year. The budget is tied to priorities, plans and specific projects approved by the County Board of Supervisors.

Property taxes are collected and distributed to local schools, the County general fund, cities, and special districts. Generally, the County receives 23 cents for every tax dollar collected. About 61 cents goes to local schools, 6 cents goes to special districts, and 10 cents goes to local cities. Incorporated cities (cities with their own City Councils) have their own government and budgets independent of the County and provide many of their own local services, such as police and fire.