How to Read Your Supplemental Tax Bill

Supplemental taxes are determined in accordance with Article XIIIA of the California Constitution, which generally requires reappraisal of property whenever a change of ownership occurs or new construction is completed. Reappraisal to fair market value is made at the date the ownership changed or new construction was completed. If the property value has increased, then a Supplemental Bill is generated which reflects the additional tax due, proportional to the increase in value, and for the share of the fiscal year to which the new values apply. If the change in values crosses fiscal years, you may receive a separate bill for each fiscal year affected.

Each section of the bill is numbered for easy reference if you need to communicate with us by phone. New technology allows color printing at the same cost as black and white, so color has been added to improve readability. Address changes may be made directly on the front of the payment stubs.

- For questions regarding values or the reason for this Supplemental Tax Bill, please contact the County Assessor's Office at 805-781-5643.

- For questions on payment, contact the Tax Collector's Office at 805-781-5831.

How to Read Sections 12-14 of Your Supplemental Tax Bill

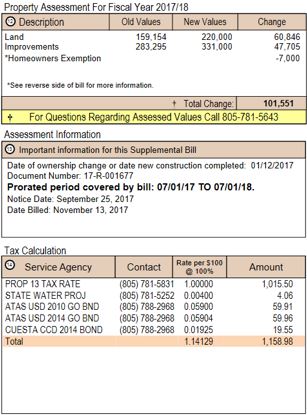

Section 12 Property Assessment for Fiscal Year

Shows the prior values, the new values, and the change in values.

Section 13 Assessment Information

Includes the date of the change, the Notice Date to the property owner, and the "prorated period," which is the portion of the fiscal year to which the new values apply. Taxes are adjusted, or "prorated," for this portion of the fiscal year. If you owned the property during this period, this is your bill. If the property sold within this period, please call 805-781-5831. Sale or transfer of the property does not relieve the assessee of this tax

Section 14 Tax Calculation

Shows the calculation and distribution of the tax. For further information on the Service Agency, please call the Contact phone number provided.