Property Tax Deadline Approaching

Author: Auditor-Controller-Treasurer-Tax Collector

Date: 4/1/2021 10:52 AM

James Hamilton, County Auditor-Controller-Treasurer-Tax Collector, reminds taxpayers that the 2nd installment of the 2020-21 secured property tax bill becomes delinquent if not paid on or before April 12, 2021. The normal April 10th deadline is extended this year because the 10th falls on a weekend.

Taxpayers are encouraged to pay online at the Tax Collector’s website or by telephone at (805) 781-5831, during business hours. Payments via electronic check can be made with no additional fee, while payments with a credit or debit card require an additional 2.39% ($3.95 minimum) fee. Please see below for more options to pay your property taxes.

Please note that recent announcements by the IRS about extended federal income tax deadlines do not change County property tax deadlines, which are set by State law.

Having difficulty paying your property tax because of the impacts of the COVID-19 pandemic?

Additional time to pay without delinquency penalties may be available. Please see our previous article for more information. Please note that a penalty waiver request cannot be considered before the April 12th deadline. Please do not pay online if you intend to request a penalty waiver. Online payments made after April 12, 2021, will include a delinquency penalty.

How to Pay Your Property Taxes:

- Tax Collector’s Website: Payments are available 24 hours per day. Electronic check payments may be made with no additional fee. Credit and debit card payments require an additional 2.39% ($3.95 minimum) fee.

- Telephone: (805) 781-5831, M-F, 8AM-5PM. Electronic check payments may be made with no additional fee. Credit and debit card payments require an additional 2.39% ($3.95 minimum) fee.

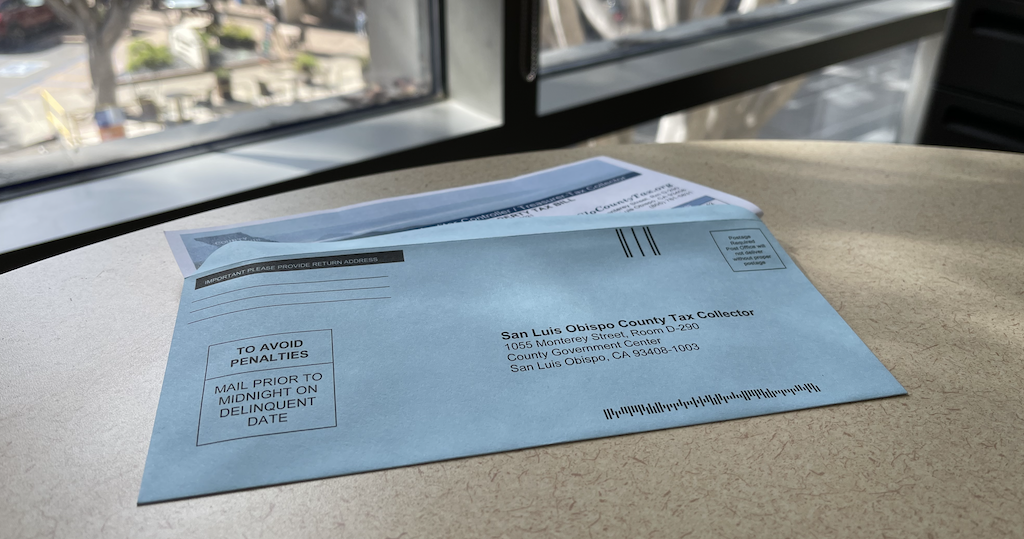

- Mail: Check payments postmarked April 12, 2021 or earlier, will be credited as timely. Please include your assessment number on your check and mail your payment to: County Tax Collector, 1055 Monterey St., Rm D-290, San Luis Obispo, CA 93408.

- In Person: Payments may be made via check, cash, electronic check, or credit/debit cards. Electronic check payments may be made with no additional fee. Credit and debit card payments require an additional 2.39% ($3.95 minimum) fee. Our office is open M-F, 8 AM-5 PM. We are located on the 2nd floor of the County Government Center, 1055 Monterey St., Rm D-290, San Luis Obispo, CA 93408.