April 10th is the Last Day to Pay the 2nd Installment of the Annual Secured Property Tax Bill Without Penalties

Author: Auditor-Controller-Treasurer-Tax Collector

Date: 4/4/2024 9:32 AM

After April 10th, state law requires that payments must also include a 10% penalty.

Taxpayers are encouraged to pay online at the Tax Collector’s website or by telephone at (805) 781-5831, during business hours. Payments via electronic check can be made with no additional fee, while payments with a credit or debit card require an additional 2.35% ($1.49 minimum) fee. Please see below for more options to pay your property taxes.

How to Pay Your Property Taxes:

- Tax Collector’s Website: Payments are available 24 hours per day. Electronic check payments may be made with no additional fee. Credit and debit card payments require an additional 2.35% ($1.49 minimum) fee.

- Telephone: (805) 781-5831, M-F, 8AM-5PM. Electronic check payments may be made with no additional fee. Credit and debit card payments require an additional 2.35% ($1.49 minimum) fee.

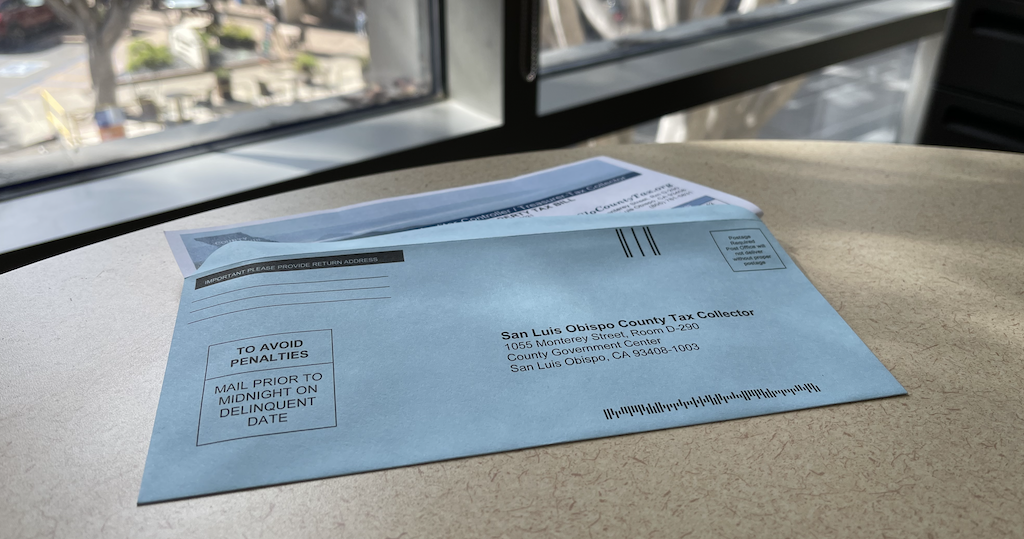

- Mail: Check payments postmarked April 10th, 2024 or earlier, will be credited as timely. Please include your assessment number on your check and mail your payment to: County Tax Collector, 1055 Monterey St., Rm D-290, San Luis Obispo, CA 93408.

- In Person: Payments may be made via check, cash, electronic check, or credit/debit cards. Electronic check payments may be made with no additional fee. Credit and debit card payments require an additional 2.35% ($1.49 minimum) fee. Our office is open M-F, 8 AM-5 PM. We are located on the 2nd floor of the County Government Center, 1055 Monterey St., Rm D-290, San Luis Obispo, CA 93408.