First Installment payments for 2019/20 Secured Property Tax Bills are due November 1st.

Author: Auditor-Controller-Treasurer-Tax Collector

Date: 10/10/2019 3:29 PM

First Installment payments for 2019/20 Secured Property Tax Bills are due November 1st.

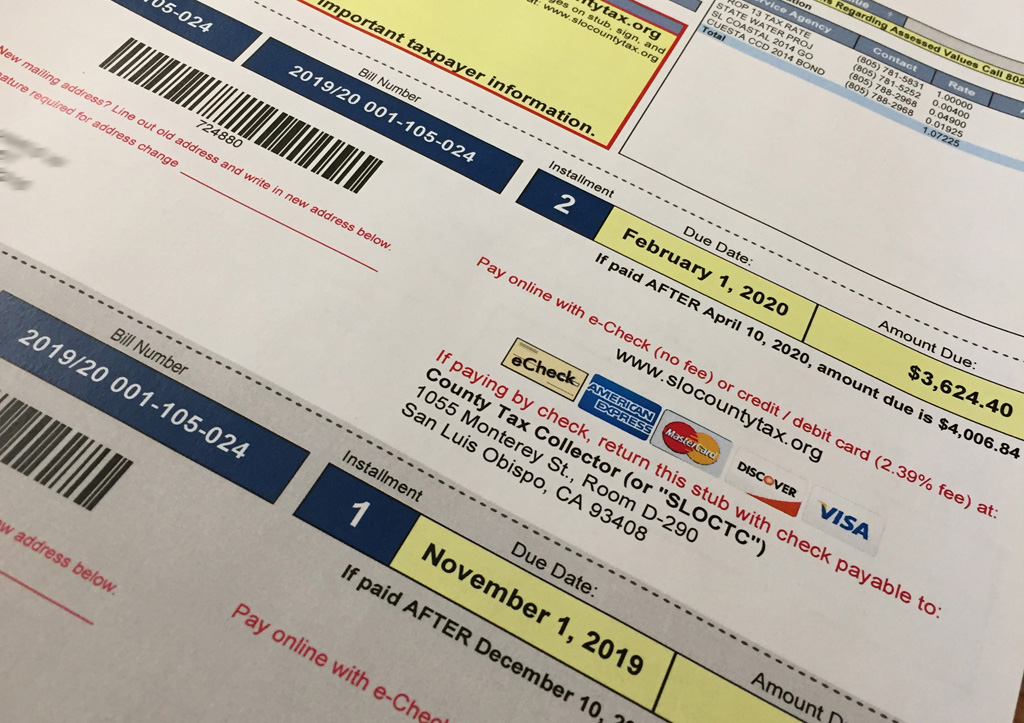

Jim Hamilton, the County Auditor-Controller-Treasurer-Tax Collector, reminds all County Taxpayers that payments for the first installment of this year’s secured property tax bill are due November 1st and will be considered delinquent if not postmarked by December 10th.

"California law requires that we add a 10% penalty if payments are not made by the delinquency date. Taxpayers have until December 10th to make their payments", said Hamilton.

Payments may be made:

- Online before midnight Tuesday, December 10th on the Tax Collector's website.

- By mail before midnight December 10th.

- At the Tax Collector's office, Room D-290, until 5:00 p.m. on December 10th.

- Please note that eCheck payments can be made with no additional fee, however credit and debit card payments require an additional 2.39% processing fee ($3.95 minimum).

If you haven't received your tax bill by November 1st, please call the Tax Collector's office at (805) 781-5831.