How to Get Delinquent Property Tax Penalties Waived (Update: State COVID Waiver Program Has Ended)

Author: James W. Hamilton, CPA

Date: 3/30/2020 1:06 PM

Jim Hamilton, San Luis Obispo County Auditor-Controller-Treasurer-Tax Collector, announced procedures for taxpayers to request waiver from property tax late charges incurred due to COVID-19 hardships. This announcement follows information released on March 20 announcing the waiver program. [Note: This program expired as of May 6, 2021.]

Update: The state program which allowed additional leniency for delinquent property tax payments due to the COVID emergency ended on May 6, 2021. To see if you qualify for penalty cancellation under current state law, please see our page on penalty cancellation requests.

Original Article:

“We recognize many taxpayers are facing difficulties with the upcoming April 10th property tax deadline and we are committed to provide relief where allowed under State Law. Taxpayers able to pay their April installment on time should continue to do so, but this program allows more time for those who have been impacted by COVID-19. We designed the claim process to be extremely simple and straightforward,” said Hamilton.

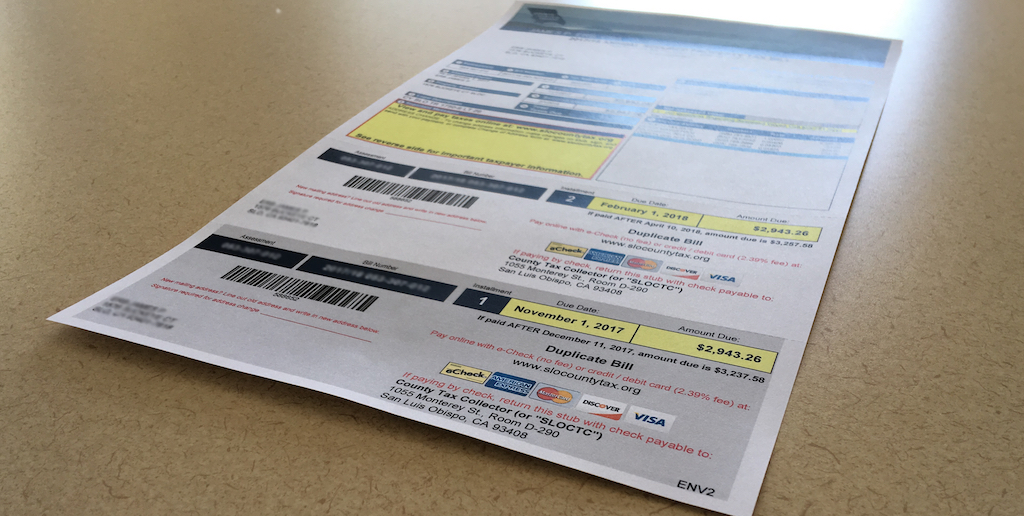

Under the announced procedure, property owners who have been impacted will be allowed to claim a waiver of penalties and interest, which are imposed by State law if the property tax bill becomes delinquent. The second installment of this year’s property tax bills become delinquent if not paid by April 10, 2020. Taxpayers who want to submit a waiver request should do so at the same time they are ready to make their tax payment.

Properties eligible for a penalty waiver are the taxpayer’s primary residence or properties associated with a small business, including vacation rentals. More details and a Waiver Request Form are available online at on the County website.

On March 28th the Tax Collector announced the extension of deadlines to file Transient Occupancy Taxes for lodging operators in the unincorporated areas of the County due to COVID-19 circumstances.

Taxpayers with questions about the waiver request process can contact the Tax Collector’s office at [email protected] or by phone at (805) 781-5831, Monday through Friday, 8 a.m. to 5 p.m.