Pay Taxes on Unsecured Property by August 31st to Avoid Penalties

Author: Auditor-Controller-Treasurer-Tax Collector's Office

Date: 7/22/2022 8:43 AM

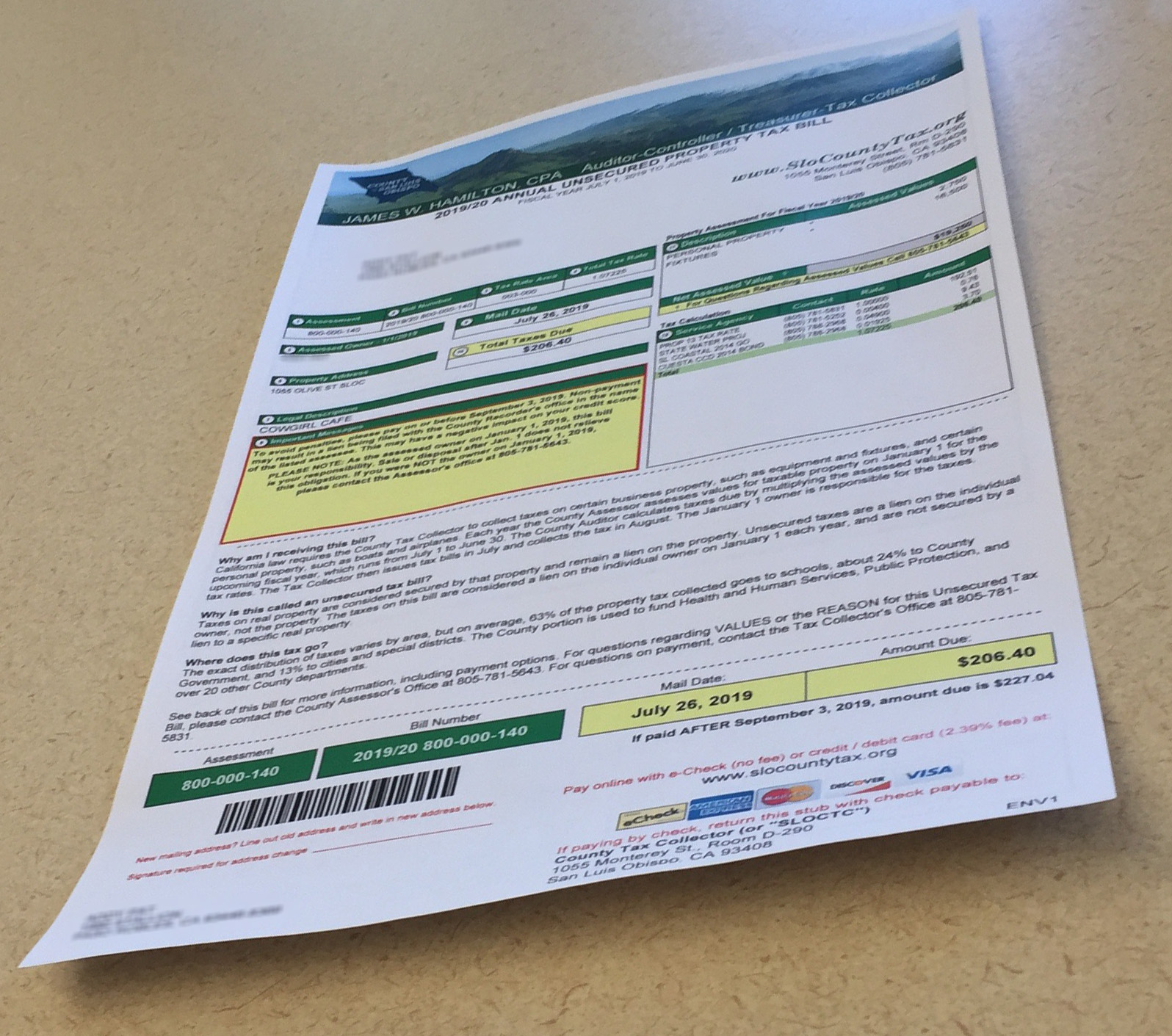

Owners of taxable unsecured business or personal property must pay their tax bills by August 31st this year to avoid a 10% penalty.

California Law requires the County Tax Collector to collect taxes on certain business property, such as equipment and fixtures, and certain personal property, such as boats and airplanes. Each year,

- The County Assessor sets the values for such property on January 1st for the upcoming fiscal year, which runs from July 1st to June 30th.

- The County Auditor calculates the taxes due by multiplying the assessed values by the tax rates.

- The Tax Collector then issues tax bills in July and collects the taxes.

The obligation to pay unsecured property taxes belongs to the owner of the unsecured property as of January 1st, when the values are set. The January 1st owner is responsible even if the property is sold, removed from the County, or destroyed after that date. The only exception comes when a signed agreement by the new owner to pay the taxes has been submitted to the Tax Collector at the close of escrow.

As with secured property taxes, the distribution of unsecured property taxes within San Luis Obispo County varies by area. On average, 63% of collected property taxes goes to schools, about 24% to County Government, and 13% to cities and special districts. The County portion is used to fund Health and Human Services, Public Protection, and over 20 other County departments.

Unlike taxes on real property, which are secured by and act as a lien on the property itself, unsecured property taxes act as a lien against the individual owner(s) and are not secured to the property.

Tax bills for unsecured property are payable in a single installment and typically become delinquent if not paid on or before August 31st.

James Hamilton, the County Auditor-Controller-Treasurer-Tax Collector, reminds all owners of taxable unsecured property to pay their tax bills promptly. “California law requires that we add a 10% penalty if payments are not mailed by the delinquency date. This year, taxpayers have until August 31st to make their payments,” said Hamilton. Failure to pay the tax bill will result in additional penalties and the recording of a lien that will appear on assessed property owner’s credit record.

Payments may be made:

- Online before midnight Wednesday, August 31, on the Tax Collector's website.

- By mail before midnight August 31st.

- At the Tax Collector's office, Room D-290, until 5:00 p.m. on August 31st.

- By phone at (805) 781-5831.

Please note that eCheck payments can be made with no additional fee, however credit and debit card payments require an additional 2.35% processing fee ($1.49 minimum).

If you haven’t received your unsecured property tax bill by July 31st, or if you have questions about your bill, please contact the Tax Collector at (805) 781-5831.