Second Installment payments for 2019/20 Secured Property Tax Bills are due February 1st.

Author: Auditor-Controller-Treasurer-Tax Collector

Date: 1/31/2020 2:52 PM

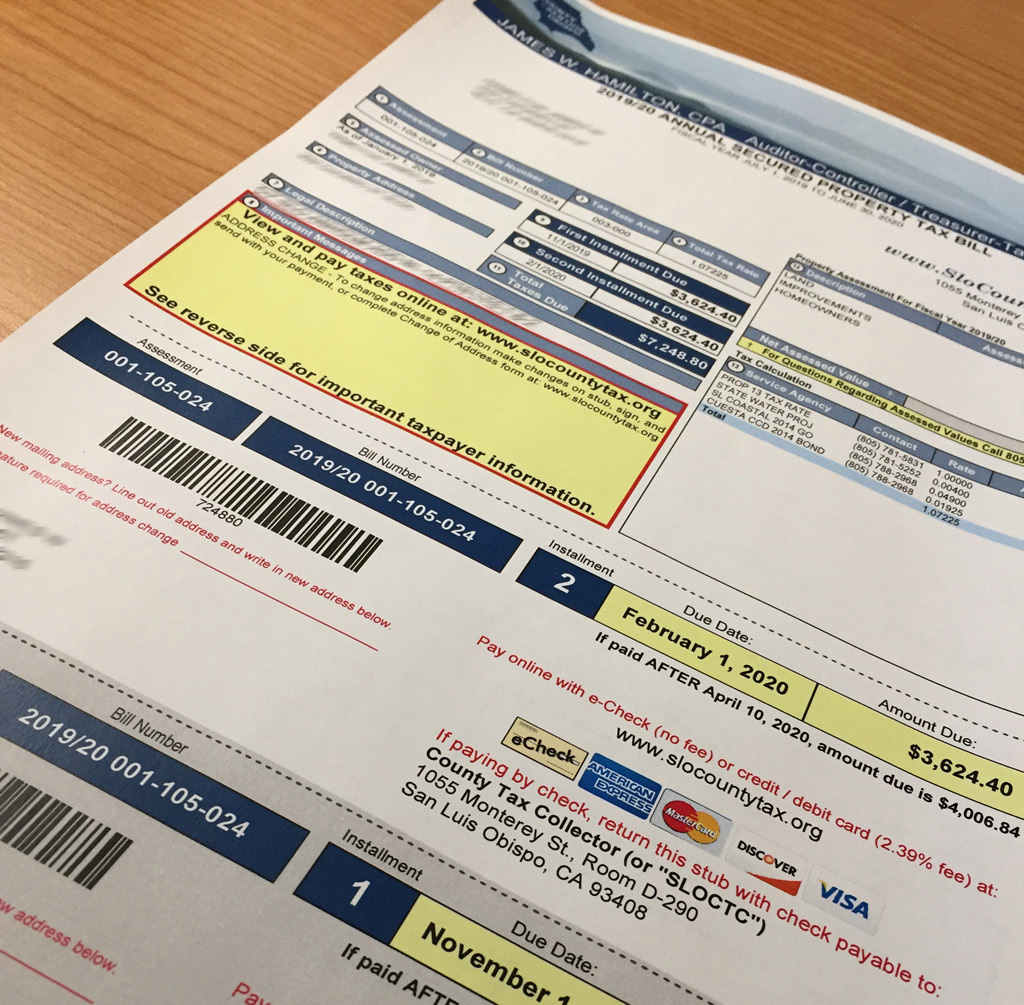

The Tax Collector advises all property owners in the County of San Luis Obispo that the second installment of the annual secured property tax bill is now due.

Jim Hamilton, the County Auditor-Controller-Treasurer-Tax Collector, reminds all County Taxpayers that payments for the second installment of this year’s secured property tax bill are due February 1st and will be considered delinquent if not postmarked by April 10th.

"California law requires that we add a 10% penalty and a $20.00 delinquent cost if second installment payments are not made by the delinquency date. Taxpayers have until April 10th to make their payments", said Hamilton. The second installment can’t be paid before the first installment is paid.

Payments may be made:

- Online before midnight Friday, April 10th on the Tax Collector's website.

- By mail before midnight April 10th.

- At the Tax Collector's office, Room D-290, until 5:00 p.m. on April 10th.

- Please note that eCheck payments can be made with no additional fee, however credit and debit card payments require an additional 2.39% processing fee ($3.95 minimum).

If you need a duplicate copy of your tax bill, please call the Tax Collector's office at (805) 781-5831.