What's in Your Property Tax Bill?

Author: Auditor-Controller-Treasurer-Tax Collector

Date: 10/19/2017 2:37 PM

Bonds and Special Assessments on property tax bills can be confusing for taxpayers. The ACTTC has created special web pages in an effort to make property taxation more transparent and easier to understand.

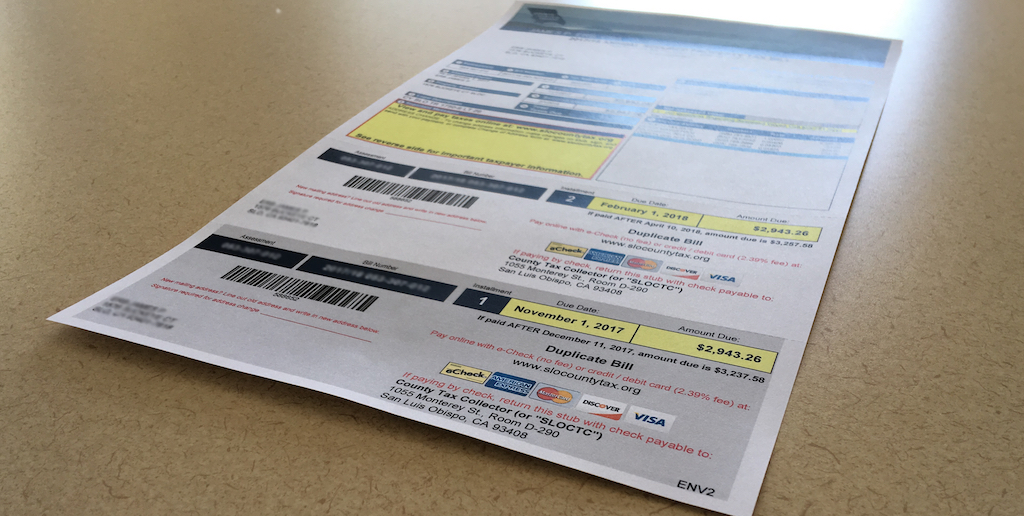

Most people know that in the State of California property taxes are based on 1% of the assessed value. But what many people don’t know is that other assessments and charges are also included in the Annual Secured Property Tax Bill. The Auditor-Controller-Treasurer-Tax Collector (ACTTC) is working to make your property tax bill easier to understand.

When viewing your property tax bill on the Tax Collector’s website, you can click on any of these assessments and charges to see more information. In the example above, clicking on the indicated link would give you more information on the Cuesta Community College District 2014 Bond which is included on this example tax bill.

Your bill includes charges for any bonds that have been approved by voters in your area. Clicking on these links will provide information about the election in which voters approved these bonds, the total amount issued, the amount to be repaid, and the estimated date of repayment.

Other items listed on your property tax bill may refer to “special assessments” for your area, including road maintenance, water districts, street lighting, or even weed abatement charges. The total tax rate included on your property tax bill is approved annually by the County Board of Supervisors. Click the link for these special assessments for more information. You may also call the phone number listed to the right of the special assessment to speak with someone regarding a particular special assessment.

Bonds and Special Assessments can be confusing for taxpayers. The ACTTC has created these web pages in an effort to make property taxation more transparent and easier to understand. Please contact our office at [email protected] or at (805) 781-5831 if you have any questions or suggestions.